BAKERSFIELD, Calif. (KERO) — Need a loan? Avoid the scams!

*Check out all of the latest BBB scam protections at joeknowsbetter.com*

No matter how much you need a loan, don't overlook this big red flag. Companies that allegedly "guarantee" loans without seeing your credit history are likely scams. These scammers charge upfront fees to lock in a loan. But once you hand over the payment, the "lender” vanishes along with your promised money.

Advance-fee loans are illegal in Canada. In Canada and the United States, it is unlawful for companies doing business by phone to promise a loan and require payment before they deliver.

How the scam works:

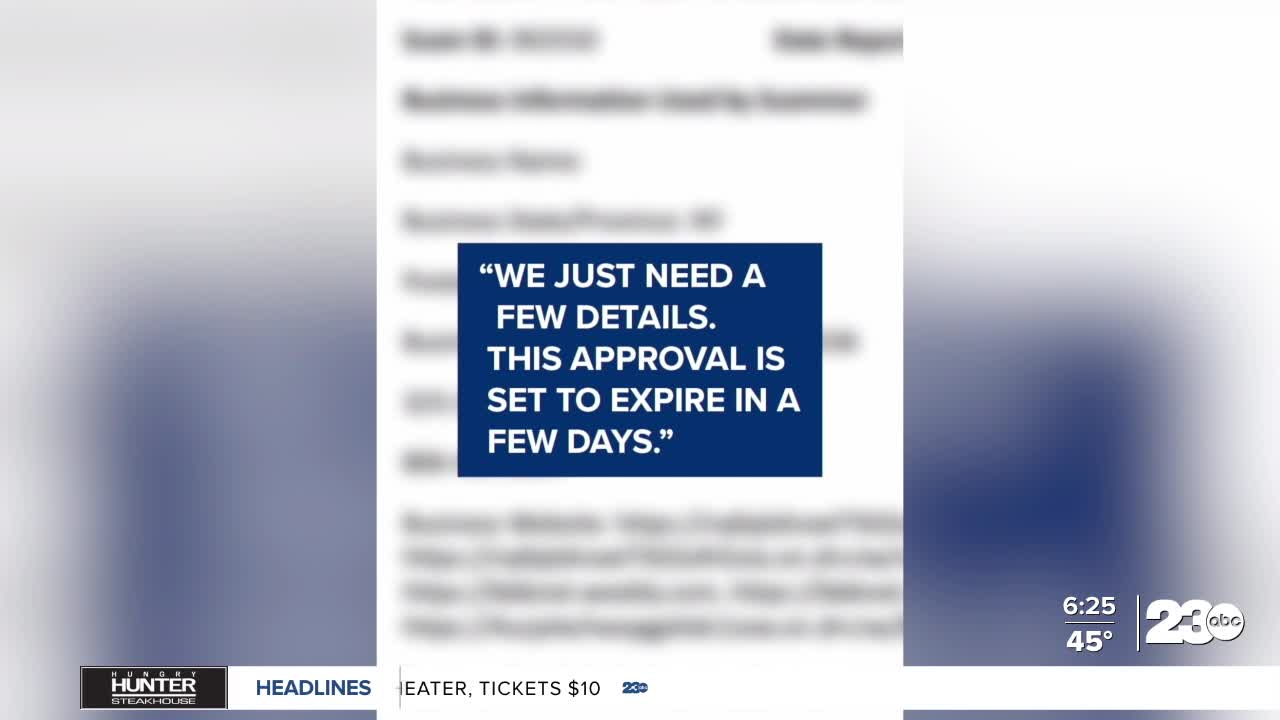

You receive an email or phone call, or see a flyer or online ad, offering you a great deal on a car, mortgage, payday, or other loan. The company may promise a "guaranteed" low interest rate or tell you that you qualify for a special program.

There are many versions of this con: home mortgage refinancing, low-cost government loans, student loan consolidation, special grants, or just an emergency loan to pay the bills. The catch is some kind of fee up front, such as a “processing fee” or insurance to get the loan or to lock in the low-interest rate. Once you hand over the payment, the "lender” vanishes along with the money.

Tips to spot this scam:

Vague or unclear fees are charged before you get the money. There are often fees charged for loans: application fees, appraisals, cand redit report fees. A real lender will post those fees prominently and collect them from the money they are lending you, but a scam lender may try to collect them as a condition for you getting money. Any up-front fee you need to pay before getting the loan is a cue to walk away.

Avoid guarantees and unusual payment methods. Real lenders never guarantee a loan in advance. They will check your credit score and other documents before providing an interest rate and/or loan amount, and will not ask you to pay an upfront fee. Fees are never paid via Green Dot MoneyPaks, iTunes cards, or wiring money. Unusual payment methods and payments to an individual are a big tip-off.

Do your research. Scammers try to trick you by pretending to be from official or trustworthy institutions (including Better Business Bureau or your current lender) or sounding like a known organization. Contact the agency directly to check if the program is real. Lenders and loan brokers must register where they do business. To check registration, in the U.S., call your state Attorney General’s office or your state’s Department of Banking or Financial Regulation. In Canada, contact the Office of the Superintendent of Financial Institutions.

For more information

Go to bbb.org to check reviews, complaints, and to hire trusted BBB Accredited Businesses.

If you’ve spotted a scam (whether or not you’ve lost money), report it to BBB.org/ScamTracker and the Federal Trade Commission https://www.ftc.gov/